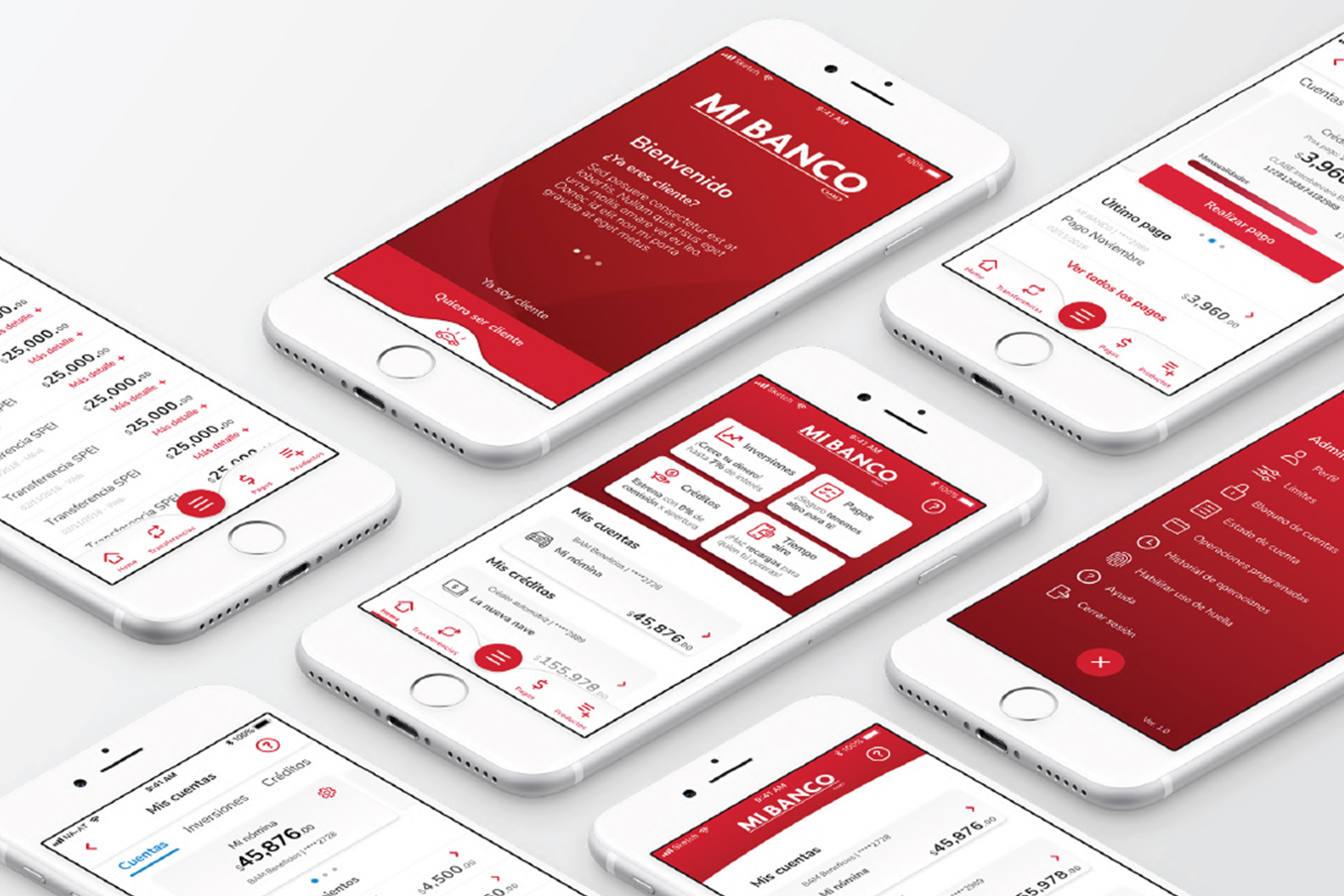

Digital Banking Experience

The objective was to design and launch Mi Banco’s inaugural mobile banking application. The app needed to serve three distinct strategic goals: empower existing customers with robust tools to manage their products, encourage the uptake of new offerings through a seamless in-app experience, and attract a new client base by offering a fully digital onboarding process—eliminating the need for branch visits or advisor assistance.

As the design lead, I was tasked with defining the product strategy and leading the end-to-end design process for this critical new channel.

Our Process

We adopted a comprehensive, user-centered design methodology to build the application from scratch, ensuring it met the needs of diverse user segments. Key activities included:

- Foundation and Strategy: We facilitated Design Thinking workshops to align stakeholders on the vision. This was followed by extensive industry benchmarking, client research, and in-depth user research to synthesize key insights that would inform our strategy.

- Architecture and Design: I led the definition of the information architecture to create an intuitive and scalable structure. We then planned and executed iterative design sprints, developing the app’s features and interface from the ground up.

- Systemization and Validation: We established a comprehensive design system and component library to ensure brand consistency and future scalability. We ran multiple usability testing sessions to validate the user experience and refine key workflows.

- Quality Assurance: Before hand-off, we performed a final, meticulous design QA to ensure the product met our high standards for quality and usability.

Key Achievements

The final product was a feature-rich, user-friendly application that successfully addressed all core business objectives, establishing a strong digital foundation for the bank.

Fully Digital Customer Acquisition: We successfully implemented digital identity verification and contract signing, creating a frictionless onboarding experience that simplified the acquisition of new customers without any need for in-branch support.

High-Value, User-Centric Features: We identified and prioritized the most valuable features for core customer segments and integrated them into a clear and accessible platform.

Streamlined Self-Service Enrollment: We co-designed intuitive self-service tools that streamlined the enrollment process for new products, making it easy for existing clients to expand their relationship with the bank.