Digitizing a Paper-Based Process

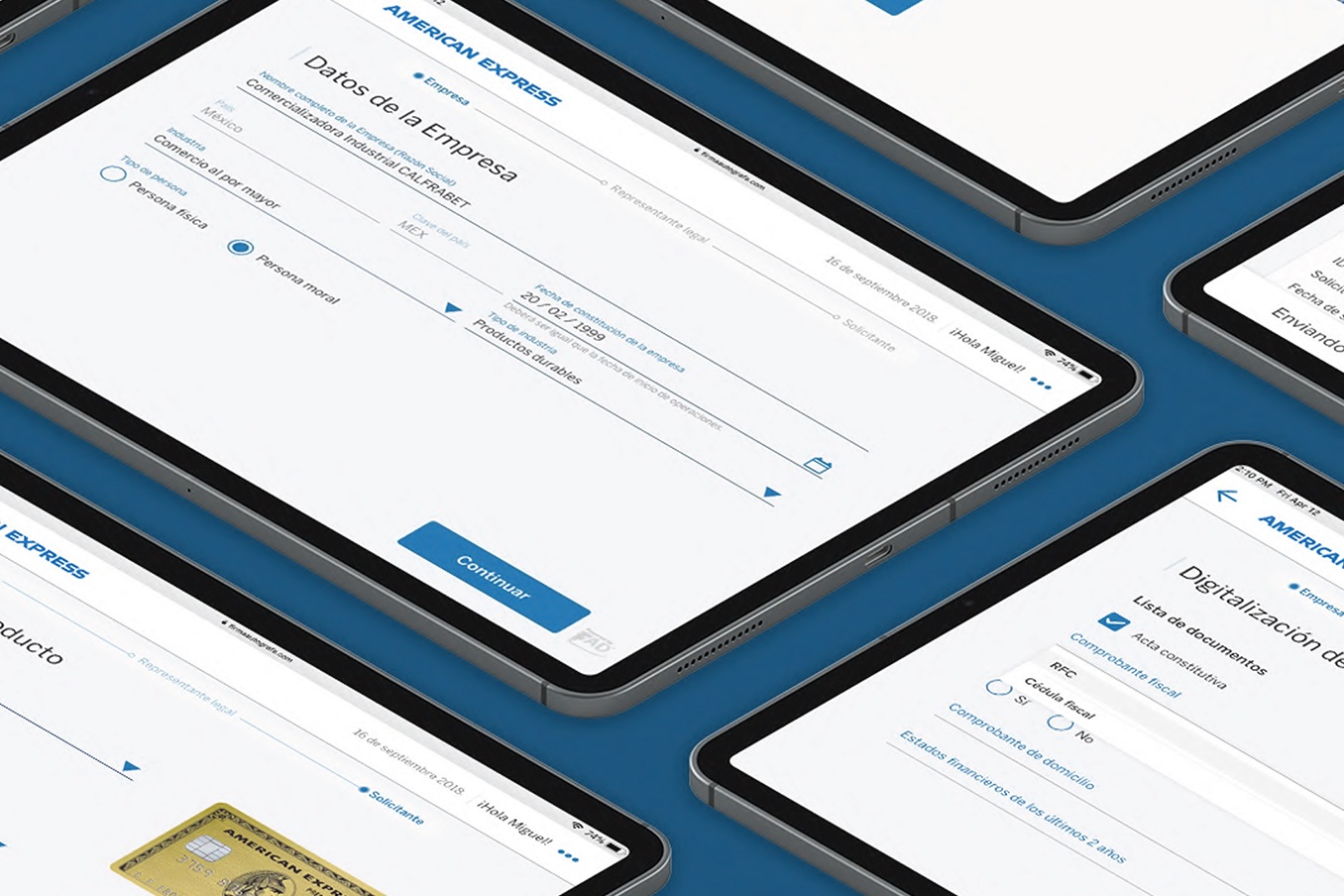

The primary objective was to transform the slow, entirely analog process for additional corporate credit-card applications into a fully digital experience. The key goals were to eliminate the reliance on manual paperwork and to dramatically slash the time required for approvals and document collection, thereby enhancing the corporate client experience and improving internal efficiency.

As the design lead, I was responsible for architecting the end-to-end digital solution that would replace the cumbersome paper-based system.

Our Process

We employed a targeted user-centric methodology to deconstruct the existing analog process and build a streamlined digital alternative. Key activities included:

- In-depth Research and Mapping: We conducted extensive client and user research to meticulously map the pain points, bottlenecks, and requirements of the existing paper-based workflow.

- Architecture and Iterative Design: Based on our research, we defined a new information architecture and user flow for the digital experience. We then planned and ran iterative design sprints to build and refine the interface.

- Systemization and Validation: We established a comprehensive design system and component library to ensure consistency across all screens and user touchpoints. We also directed usability testing sessions to validate the new, improved workflows and gather direct user feedback.

- Quality Assurance: Before hand-off, we performed a meticulous final design QA to ensure the digital platform was robust, secure, and ready for launch.

Key Achievements

The project was a major success, completely modernizing a critical business process and delivering significant improvements in speed and efficiency.

- Achieved 100% Digital Transformation: We successfully converted the end-to-end application process into a fully digital experience, completely eliminating the need for manual paperwork and physical document handling.

- Drastically Reduced Processing Times: The new digital workflow slashed the average time for approvals and document collection by over 75%, reducing a process that previously took days down to a matter of hours.

- Enhanced the Corporate Client Experience: The streamlined, user-friendly digital solution significantly improved the overall corporate client experience, resulting in higher satisfaction and faster access to credit for new cardholders.